Life Insurance in and around Winter Haven

State Farm can help insure you and your loved ones

What are you waiting for?

Would you like to create a personalized life quote?

- Haines City

- Lake Wales

- Central Florida

- Lake Alfred

- Dundee

- Polk County

- Auburndale

- Waverly

- Davenport

- Eagle Lake

- Mulberry

- Bartow

- Lakeland

- Polk City

- Plant City

- Poinciana

- Eloise

- Clermont

- Orlando

- West Scenic Park

- Lake Bentley

- West Lake Wales

- Eaton Park

- Highland city

Your Life Insurance Search Is Over

When you're young and a recent college graduate, you may think you don't need Life insurance. But it's a great time to start looking into Life insurance to prepare for the unexpected.

State Farm can help insure you and your loved ones

What are you waiting for?

Winter Haven Chooses Life Insurance From State Farm

Coverage from State Farm helps you rest easy knowing your family will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the many expenses that come with providing for children, life insurance is a definite need for young families. Even if you or your partner do not have an income, the costs of filling the void of before and after school care or daycare can be excessive. For those who aren't parents, you may want the peace of knowing your funeral is covered or have debts that are cosigned.

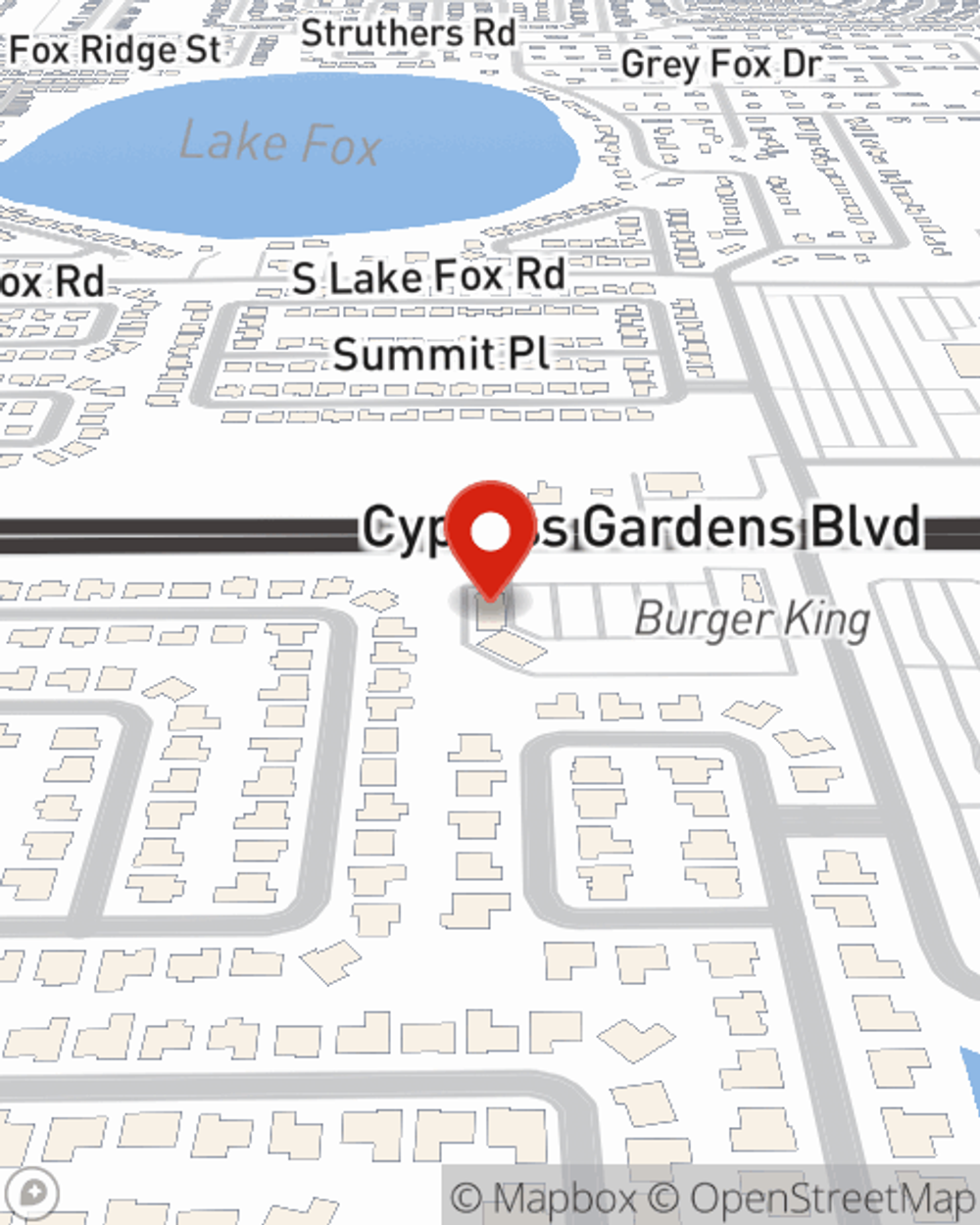

If you're a person, life insurance is for you. Agent Rob Geraghty would love to help you discover the variety of coverage options that State Farm offers and help you get a policy that works for you and your loved ones. Visit Rob Geraghty's office to get started.

Have More Questions About Life Insurance?

Call Rob at (863) 877-0672 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Rob Geraghty

State Farm® Insurance AgentSimple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.